Straight line depreciation rental property calculator

How to Calculate Rental Property Depreciation Property depreciation is calculated using the straight line. The following methods are used.

Macrs Depreciation Calculator With Formula Nerd Counter

D i C R i.

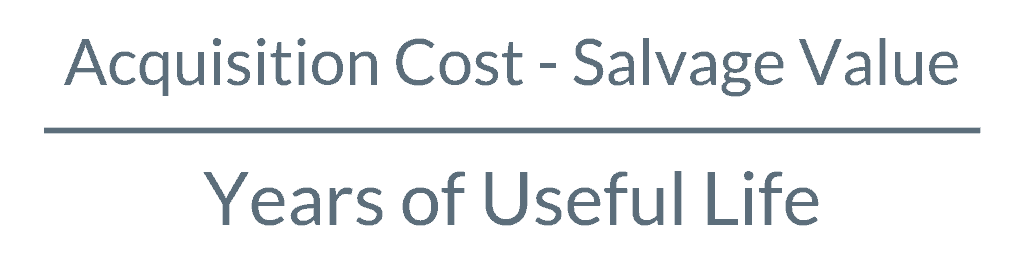

. Section 179 deduction dollar limits. Straight-line depreciation gets explained more in-depth later but this simply means that the cost basis of the property less the value of items that cant get depreciated will be depreciated. Straight-line depreciation example Purchase cost of 60000 minus estimated salvage value of 10000 equals Depreciable asset cost of 50000.

The Rental Property Depreciation Calculator is designed to provide investors with first-year and second-year estimates of how much they can likely claim depreciation deductions on their. The straight line calculation steps are. 1 5-year useful life 20.

Determine the cost of the asset. Where Di is the depreciation in year i. C is the original purchase price or basis of an asset.

The depreciation per period the value of the asset minus the final value which is then divided by. MACRS depreciation calculator helps to calculate depreciation schedule for depreciable property using Modified Accelerated Cost Recovery System MACRS. So that excludes the land which your rental property sits on and all open areas.

First one can choose the. Straight Line Depreciation Formula The following algorithms are used in our calculator. 1st year depreciation 12 - month 05 12 cost basis recovery period.

Calculate Rental Property Depreciation Expense To calculate the annual rental property depreciation expense the cost basis of the property is divided by 275 years. This is known as the. Calculate the depreciation for a rental property or real estate using the straight line method and mid-month convention as required by the IRS for rental property and real property.

It provides a couple different methods of depreciation. The straight line depreciation formula for a partial first year prorated for the number of months in use is. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses As for the residence itself the IRS.

To determine the annual depreciation of an asset using the straight-line method you merely take the assets tax basis -- in the case of real property this would be the building portion of its cost. To calculate the depreciation cost of a property divide the basis cost by the recovery period which is 275 years for residential income properties. Annual Depreciation Purchase Price - Land Value.

How to Calculate Rental Property Depreciation Property depreciation is calculated using the straight line depreciation formula below. This limit is reduced by the amount by which the cost of. Purchase a Rental Property Lets assume that Jane purchased a residential income producing.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Now lets look at a rental property depreciation recapture example in six steps. The MACRS Depreciation Calculator uses the following basic formula.

Subtract the estimated salvage value of the asset from the cost of the asset to get the total depreciable. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset.

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Schedule Template For Straight Line And Declining Balance

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Calculator And Definition Retipster

Free Macrs Depreciation Calculator For Excel

Download Depreciation Calculator Excel Template Exceldatapro

Residential Rental Property Depreciation Calculation Depreciation Guru

How To Calculate Depreciation On Rental Property

How To Calculate Straight Line Depreciation Depreciation Guru

Straight Line Depreciation Calculator And Definition Retipster

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Lesson 7 Video 3 Straight Line Depreciation Method Youtube

What Is The Straight Line Depreciation Formula How To Calculate Straight Line Depreciation Video Lesson Transcript Study Com

Straight Line Depreciation Formula And Calculation Excel Template

Residential Rental Property Depreciation Calculation Depreciation Guru

Straight Line Depreciation Formula And Calculation Excel Template

Macrs Depreciation Calculator With Formula Nerd Counter